PROJECT OVERVIEW

MY ROLE

Product Design Lead

User Research

CLIENT

Stash

TIMELINE

March—April 2023

Problem Overview

How might we make canceling your Stash subscription painless?

By conducting discovery workshops, analyzing data, and collecting customer feedback, my PM and I were able to identify the high-level problems with the cancellation experience.

#1 driver of negative reviews

Based on Zendesk data, Stash received 8,805 tickets related to cancellations in the previous month, making it the top issue for our CX agents to address.

Cancel discoverability is low

61% of customer contacts cited difficulty finding where to cancel their subscription.

SEC Regulatory concerns

Stash could face regulatory action as BBB reports of difficulty cancelling increase.

Cost to maintain "dead" accounts

Maintaining partially closed accounts cost Stash $25,000 per month.

IRA negative dead-end pattern

The existing cancel experience forced IRA customers to sell off investments and wait 2-3 days to cancel accounts.

Cancellation bank link failures

78% of all close account failures are due to not having a linked bank account at the time of closure

Discovery

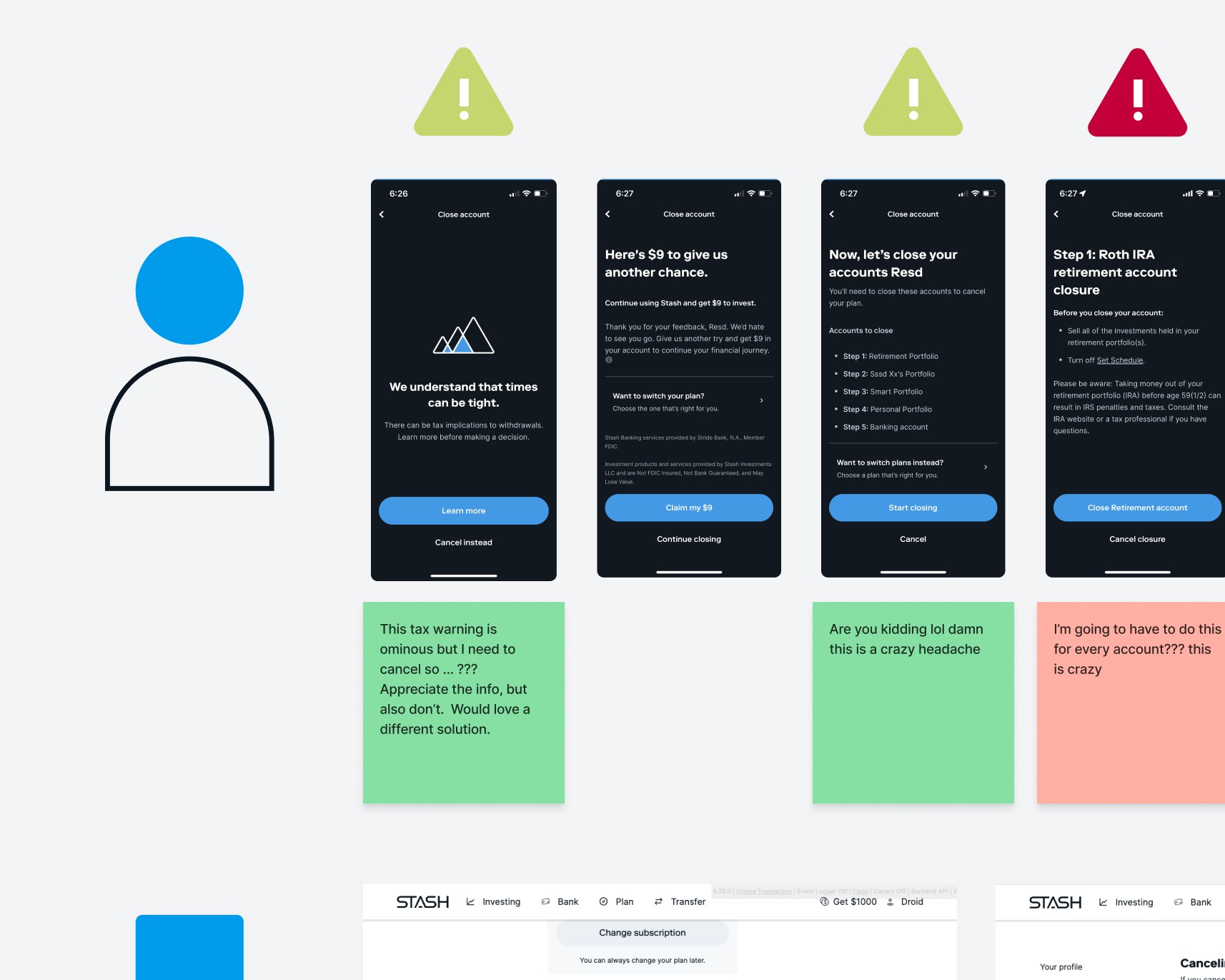

To gain insight into the customer experience of canceling a subscription, my PM and I co-ran a Flow Review.

Flow reviews are a collaborative audit that is used to maximize customer empathy, and discover problems within current product experiences. We then rally the team to brainstorm solutions based on the findings of the audit.

01

I began by gathering a diverse group of stakeholders from across different disciplines, including UX researchers, designers, marketers, and compliance. This ensures that we cast a wide net of perspectives when it comes to auditing and brainstorming solutions.

02

Each participant selects a test user account and a specific platform to audit. They then go through the cancellation flow, screenshotting, and annotating issues they experience.

03

I then extract findings from our participants and dedicate time at the end of the review to brainstorm solutions. The most alarming finding of this flow review was that our success rate for canceling test accounts was 0%.

Solutioning

Based on the ideas and data gathered from the flow review, I mapped out a flow chart of our ideal state for cancellation.

From this flow chart, my PM and I broke down the experience into our roadmap. Our plan consisted of 3 separate iterations each focusing on unique problems. We took a iterative approach in order to efficiently observe the results of our efforts and maintain the velocity of our progress.

Ideal flow for Cancellation

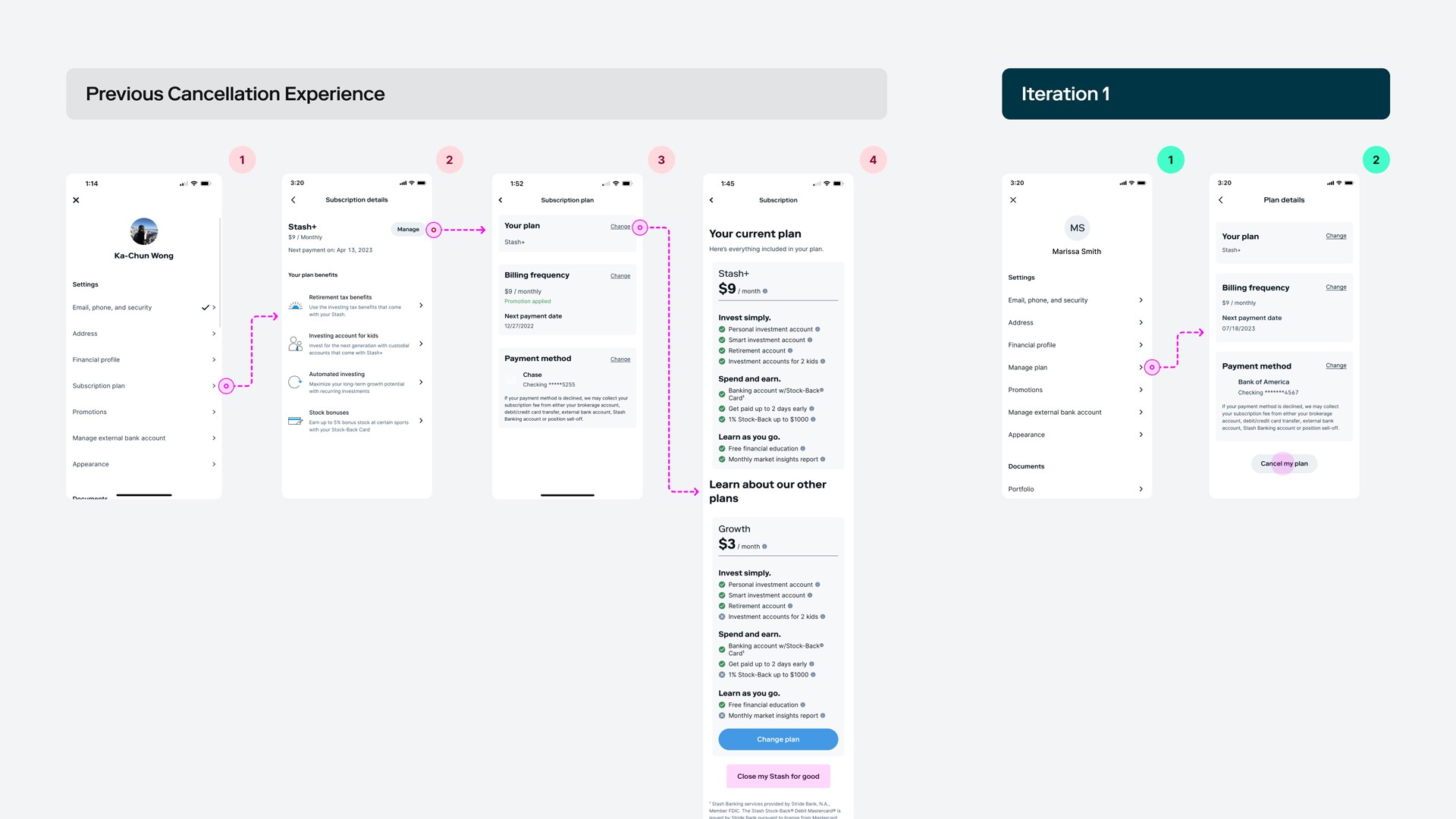

Iteration 1

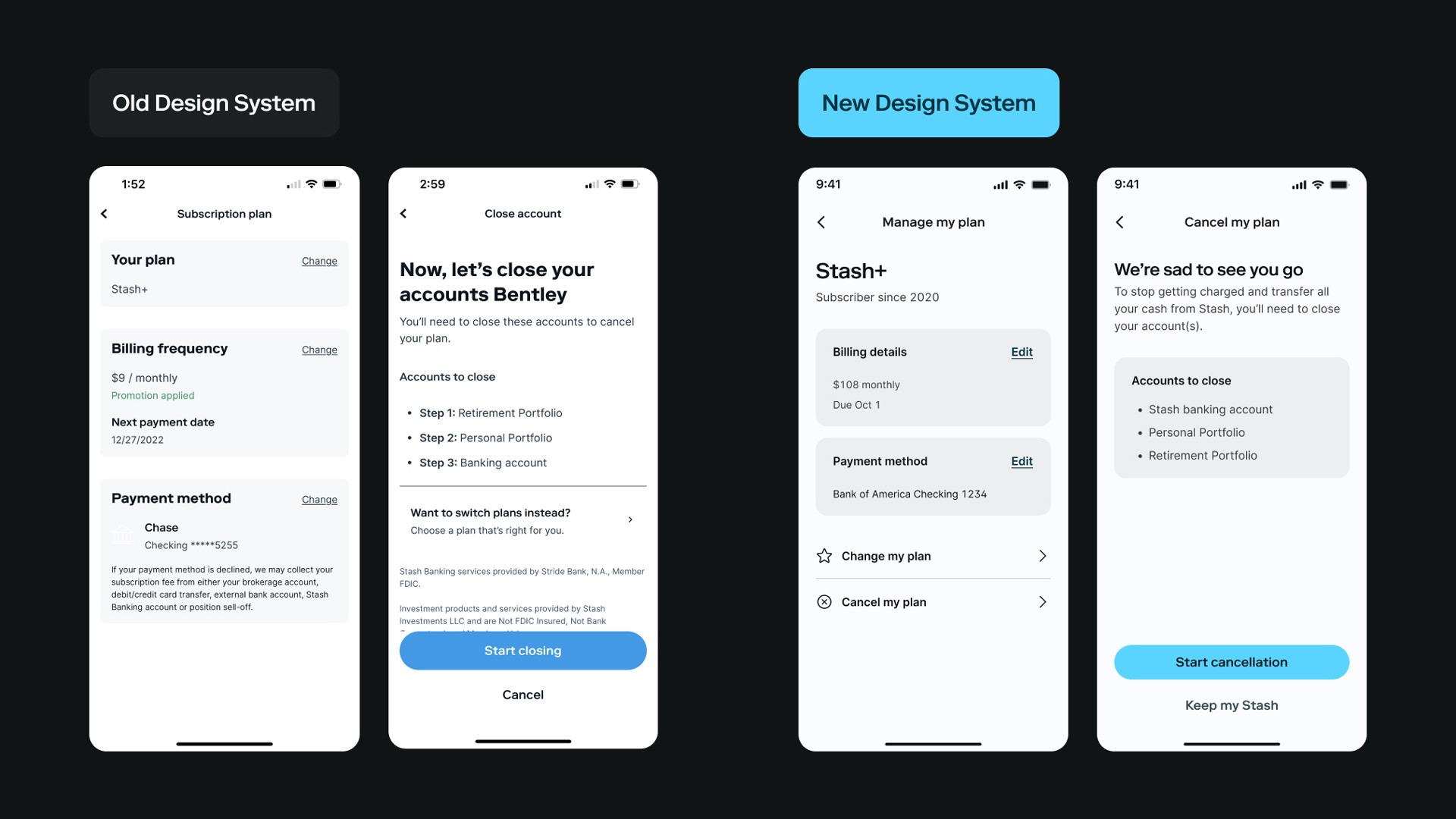

01—IMPROVE DISCOVERABILITY

The previous experience made it difficult to cancel a subscription by burying the cancellation entry point two clicks away from the settings screen. The cancellation button was also placed at the bottom of a long screen that overviewed subscription plans, and it was styled as a tertiary call to action, which made it even more difficult to find.

My proposed solution was to eliminate the unnecessary "Subscription details" screen and move the "Cancel my plan" CTA to the "Subscription plan" screen. In addition, I worked with Content Design to update the copy on the settings screen from "Subscription plan" to "Manage plan" to add clarity and intention.

02—REMOVE MISLEADING SCREENS

We saw a 27% drop-off before users even initiated the process of consenting to close their investment accounts. I hypothesized that some of these screens may have provided a false sense of success, leading customers to drop off thinking they had already completed the process.

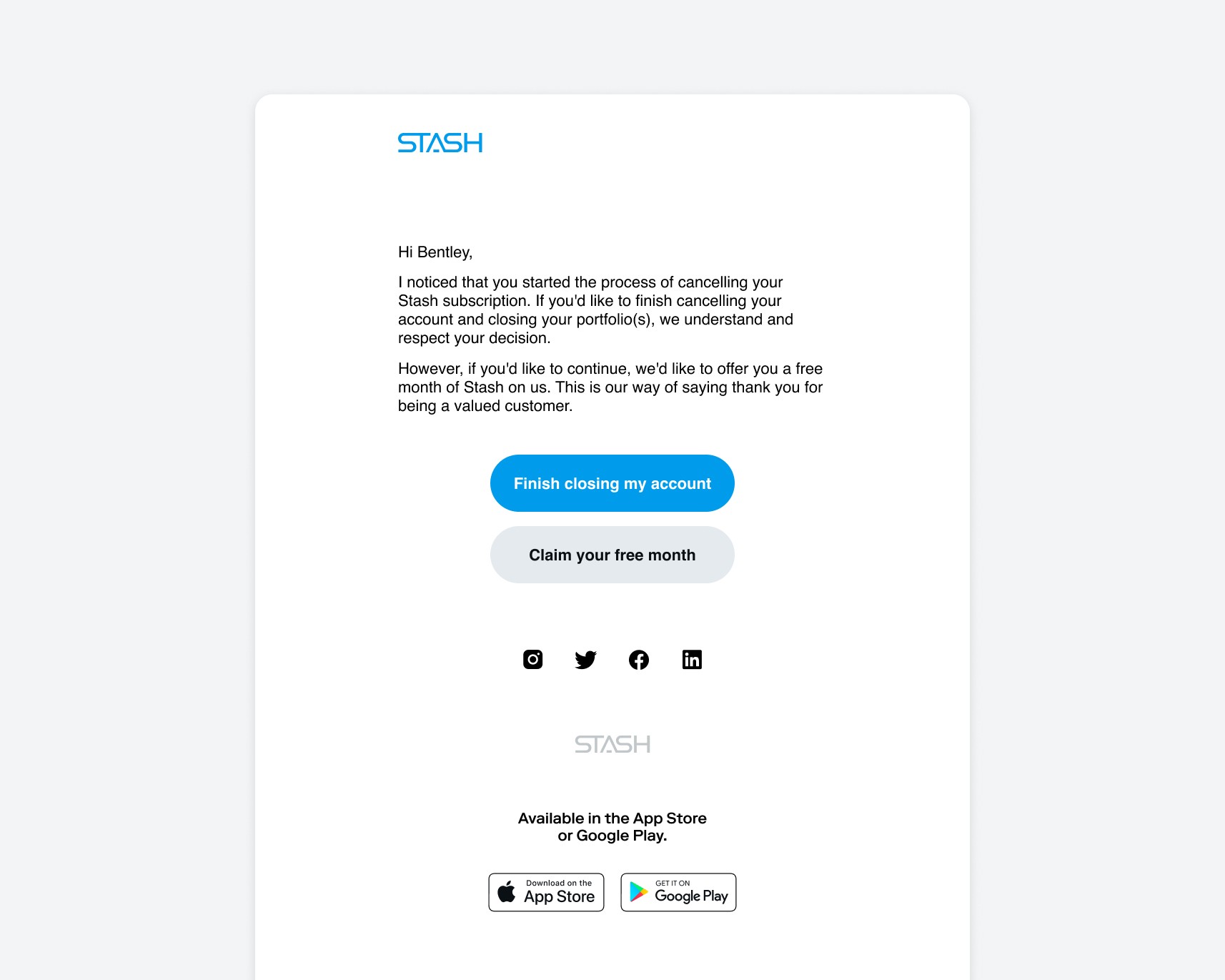

03—PRODUCT COMMS

We set up a system to send follow-up communications to customers who had not completed their cancellation process. This helped to avoid the situation where customers believed they had canceled their subscription, but their subscription had not actually been canceled.

Results

CANCEL DISCOVERY

CANCELLATION SUCCESS RATE

CANCEL RELATED APP REVIEWS

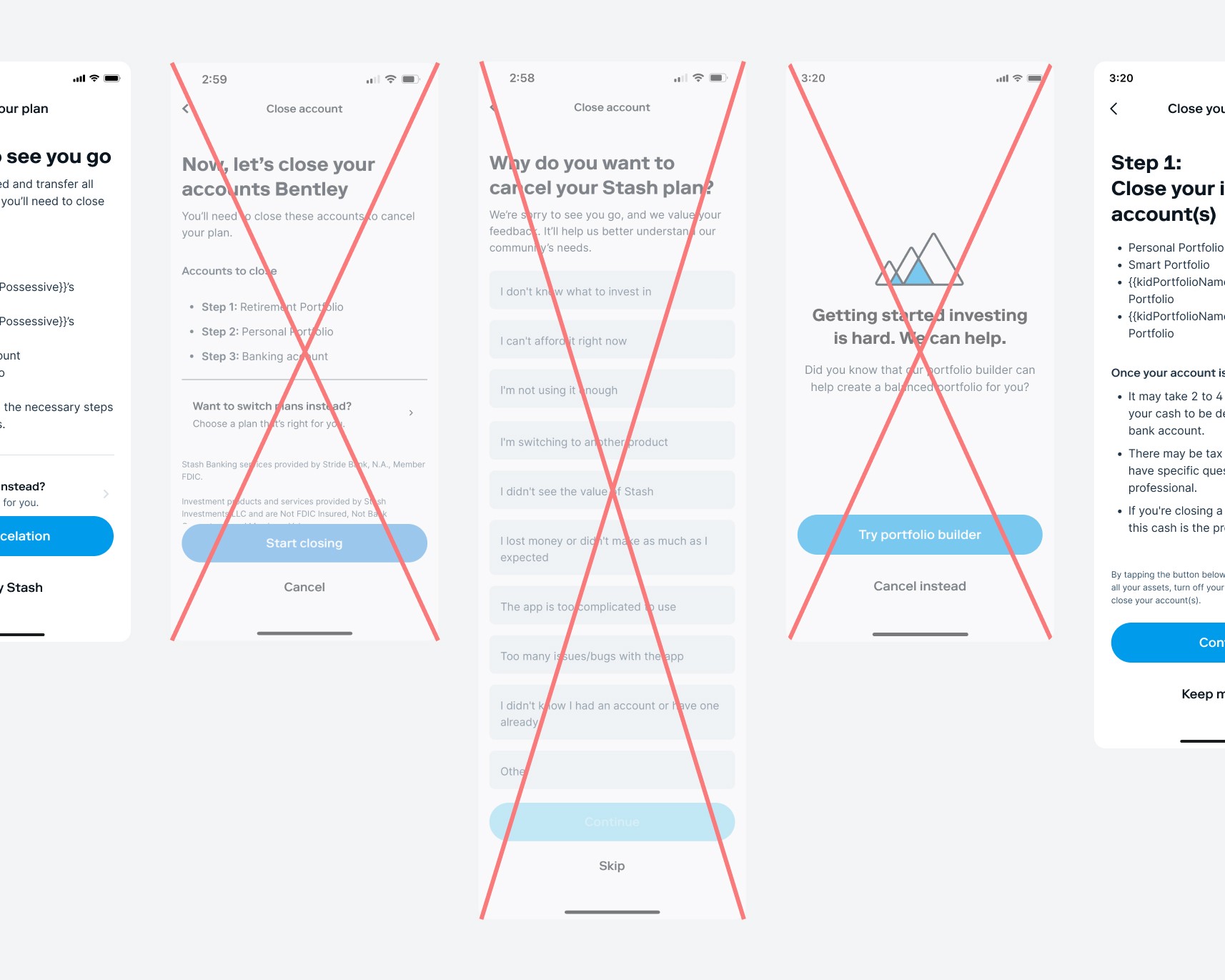

Iteration 2

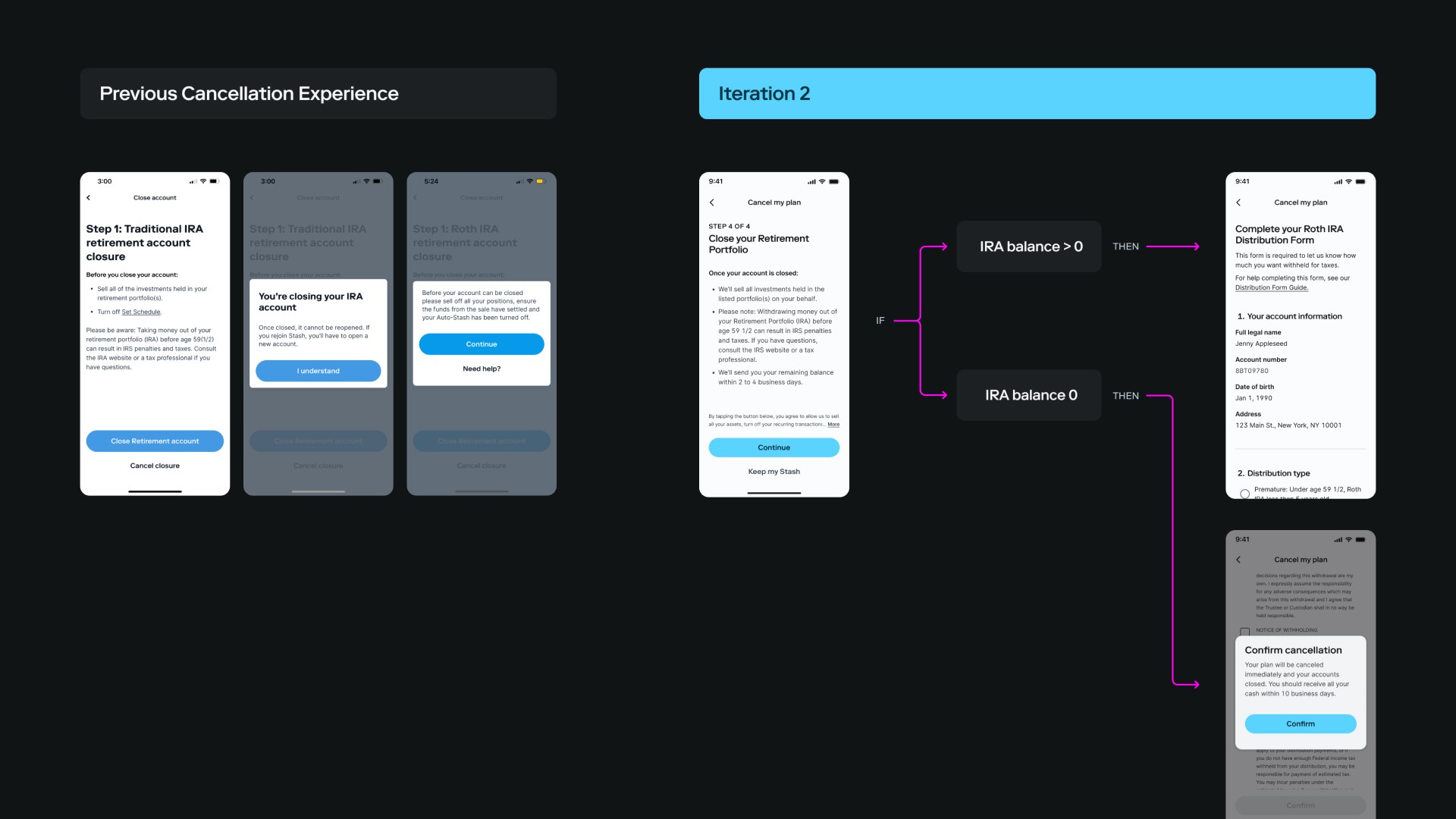

01—AUTOMATE IRA ACCOUNT CLOSURE

One of the biggest insights from our flow review was that all of our peers who attempted to cancel their test accounts were unable to do so at the point where they were required to close their IRA accounts. This is because we had an existing negative pattern where customers had to leave the cancel process to sell each individual investment they held in their IRAs. They then had to wait 2-3 days for their investment sales to settle before coming back to start the cancellation process all over again.

My proposed design solution was to automate the arduous process of selling off your IRA holdings one by one. Once customers consented to close their IRAs, they would be directed to a distribution form to confirm their tax withholdings and distribution amount.

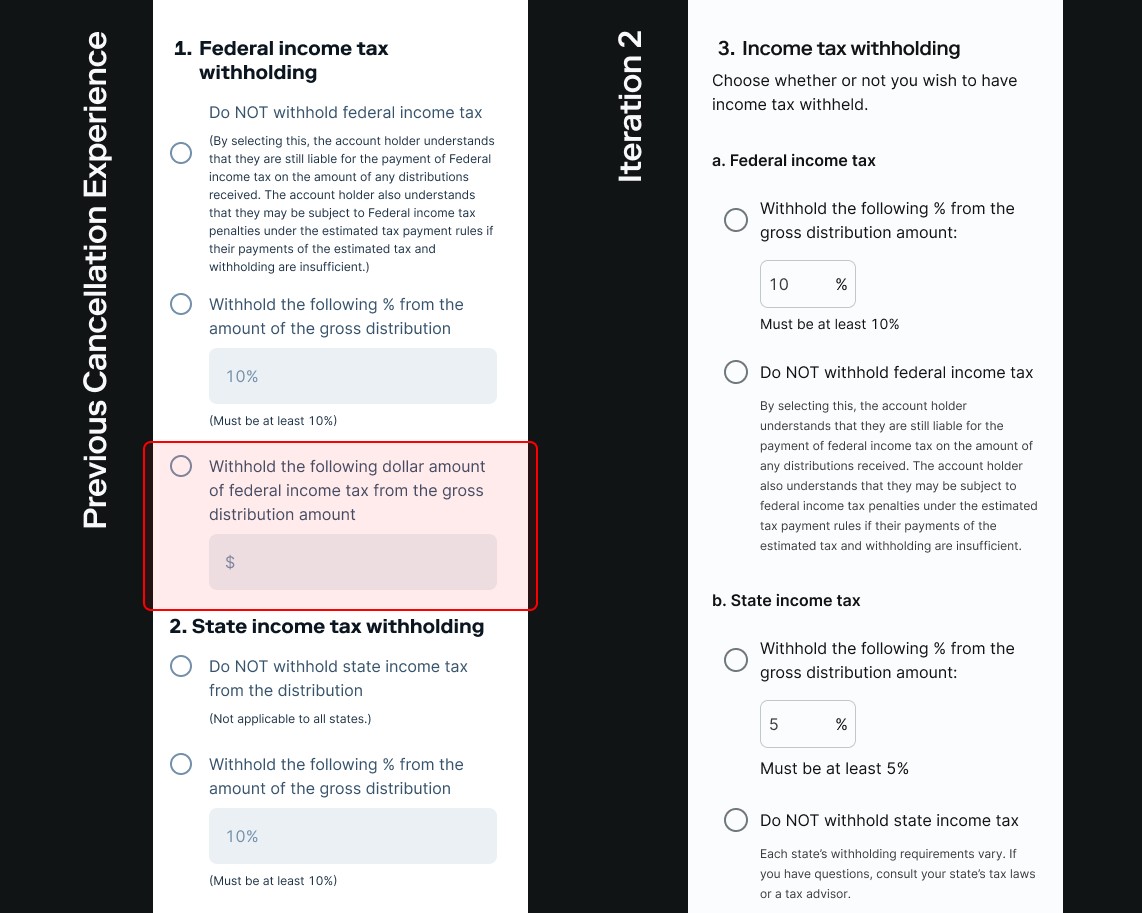

02—DISTRIBUTION FORM FIXES

One of our engineers discovered that the cash amount tax withholdings form field did not have a validation state. This meant that users could enter any amount they wanted, which could have led to them not withholding the required 10% of their distribution.

To prevent this, I removed the form field altogether since having the cash vs percentage option was redundant and not consistent with what I was seeing from the competitive analysis. This change prevented users from having to refile their distribution, as they could be confident that the correct amount had been withheld for taxes.

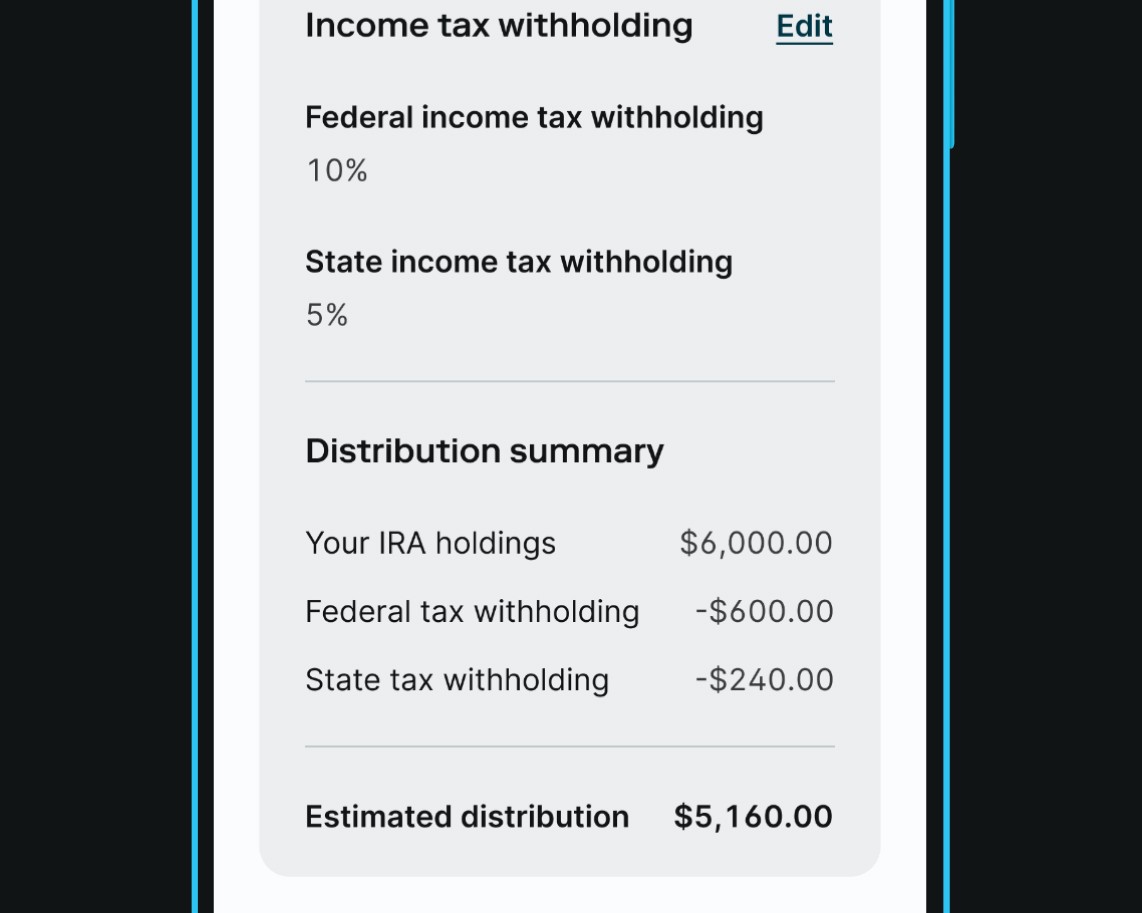

03—DISTRIBUTION SUMMARY

I designed a distribution summary section to help inform customers of an estimated amount they can expect to receive from their IRA distribution.

04—UPDATED COMPONENTS & STYLES

As a core contributor to Stash's Design System, I advocated for the use of reusable components in this iteration. This would speed up development time for future iterations and allow us to focus on improving our fundamentals of visual design, such as hierarchy and spacing.

Iteration 3

01—FIX BANK LINKING ISSUES

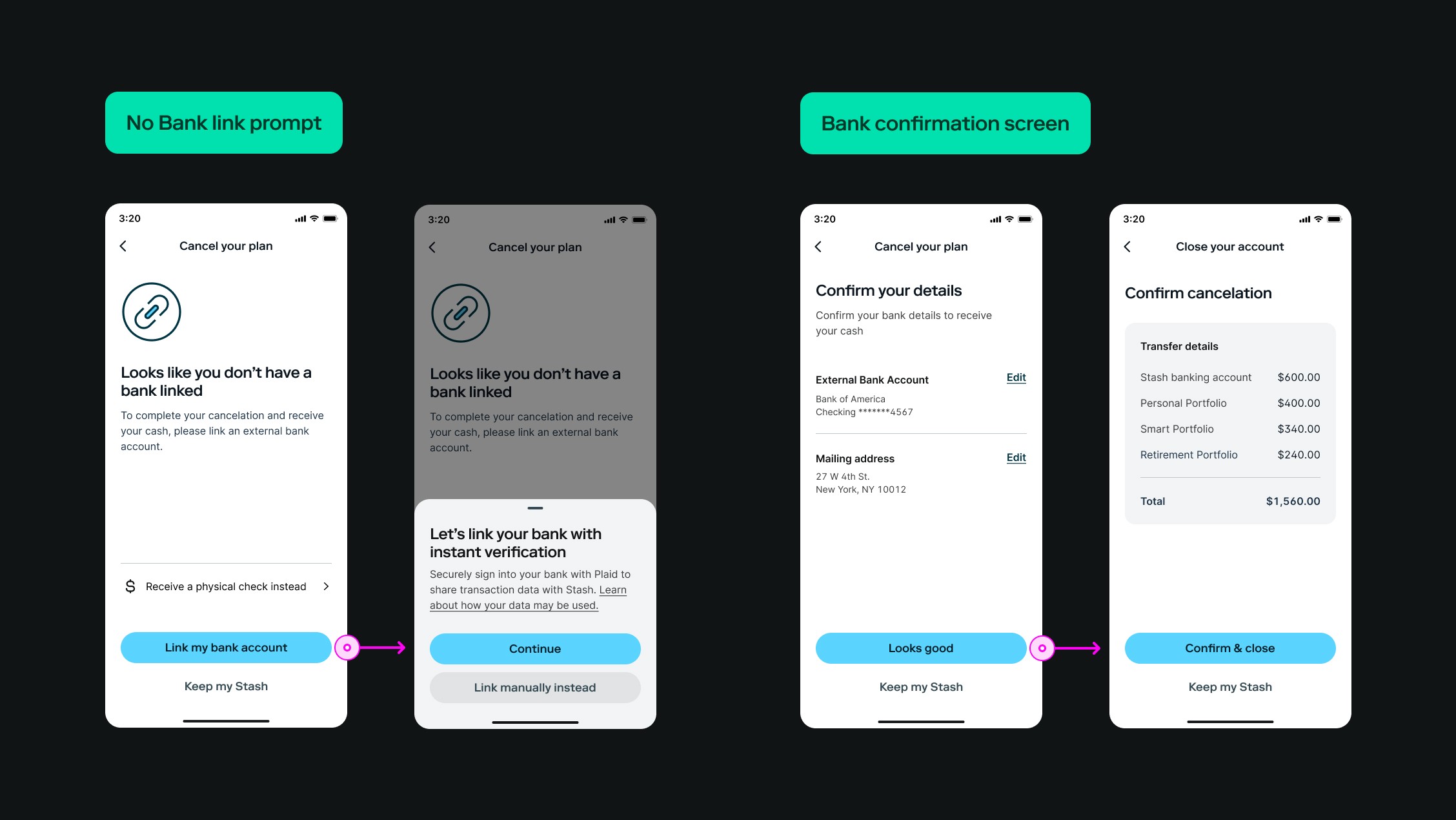

78% of all closed account failures are due to not having a linked bank account at the time of closure—I proposed two solutions to this issue.

Add a confirmation screen step to ensure that users have the opportunity to review their bank details and mailing address. This will prevent any mishaps down the line, such as users not receiving their money. The added confirmation of the mailing address is a fallback so that if any banking issue does occur due to our third-party services, the customer will still receive a physical check for their money.

Add a sad path state to prompt users to link their bank account if they do not already have one linked. This will ensure that users receive their money in a timely manner.

Learnings

Unfortunately, there are no results for Iterations 2 and 3 at this time. This is due to a major re-org that took place after Iteration 1. As a result, everything past Iteration 1 was handed off to another team. However, based on the numbers from Iteration 1, I am confident that both Iterations 2 and 3 would have yielded impactful results.